Domestic Disappearance

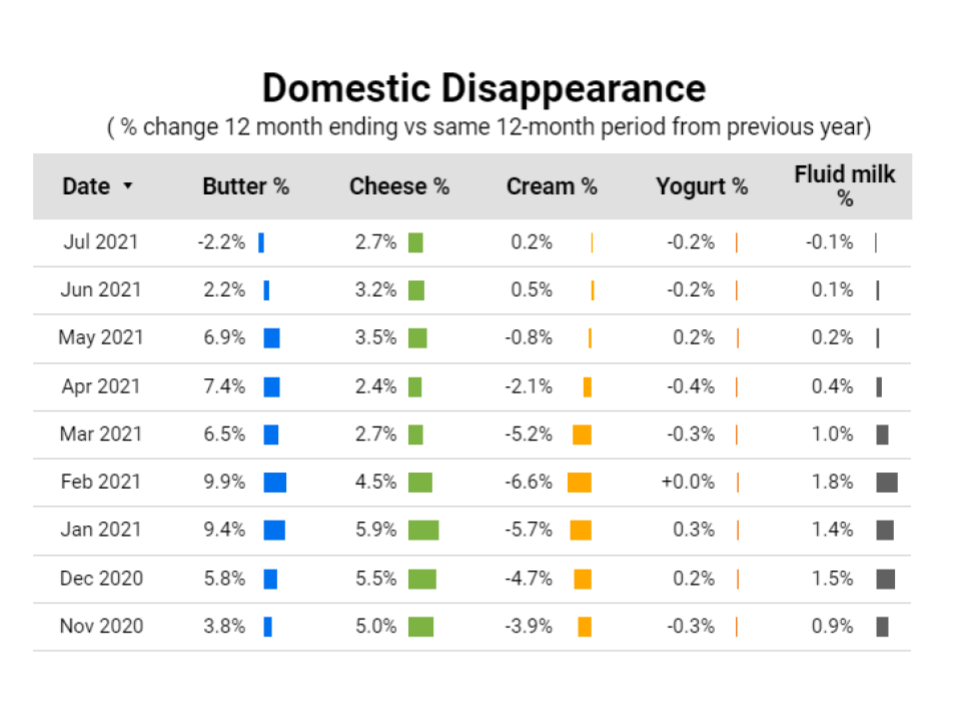

Domestic disappearance for butter shows a decrease of 2.2% for the 12-month period ending July 2021.

After a high increase in 2020 and beginning of 2021, it seems that consumption of butter in Canada is back to a more “normal” level (i.e. pre pandemic level). However, it’s important to put into context the July 2021 decrease. Indeed, butter domestic disappearance was very high since the beginning of the pandemic, boosted by home cooking and baking. With people slowly back to office work and restaurants reopening, the home baking trend is slowing down.

Furthermore, July is usually a slow month for butter consumption. We will have a better idea of the long-term trend by the end of the year when data for the holiday season will be captured.

It will also be important to track dairy products consumption after the price increase in February.

For the 12-month period ending July 2021, domestic disappearance for cream is up by 0.2%. Cream consumption was highly impacted by the restaurants’ closure during the pandemic ( 60% of cream is sold at restaurants and for further processing). With the reopening of restaurants, cream sales are slowly picking up.

Cheese disappearance is still strong, around 3% increase year over year. However, it’s important to note that the consumption of Canadian made products (i.e. net of imports) is lower. The graph below clearly shows an increase in cheese imports since the implementation of CETA in September 2017.

TRQ fill rates

CETA & WTO

CETA is in its 5th year of implementation. As of the beginning of December 2021, CETA Cheese TRQ fill rate was at 94%, CETA Industrial cheese at 91% and WTO at 93%. By the end of the year, these TRQs are expected to be filled at almost 100%.

2022 will be Year 6 and the TRQ will be capped at 16,000 metric tonnes for cheeses and 1,700 metric tonnes for industrial cheeses.

Main cheeses imported from the EU in 2021 are Parmesan (2,600 tonnes), Gouda (1,800 tonnes) and Swiss/Emmental (1,300 tonnes) and Mozzarella (1,000 tonnes). These 4 categories represent more than 50% of the total 2021 TRQ (13,333 tonnes).

CPTPP & CUSMA

As we are closing year 2021, tables below show the fill rates of calendar year dairy products for both CPTPP and CUSMA.

What we will be looking at in 2022:

- UK accession to CPTPP

- Canada-UK Free Trade Agreement negotiations

- Possible accession demand to the CPTPP by the US

Looking for more of the latest statistics and information on Canada’s dairy processing industry? Visit the DPAC Data Dashboard.